So it seems the most persistent myth of the stock market, and most common intellectual mistake in trying to understand the stock market, is to look at the real economy and project it upon the market. In fact, it would seem that the financial press makes a full-time job of maintaining the myth of that correlation.

Yet, the stock market is what we should look at to understand where the economy is going, not where it is. The market and the economy are extremely correlated, but inverse of what seems logical. We tend to want to see the economy as an indicator of what will happen to the markets. In our opinion, we need to reverse this, the market will tell us what will happen to the economy and we believe it is the most reliable economic indicator we have.

The resulting dilemma this leaves investors with today is the obvious question of why and how could the market be up in the last few months in the face of such bad news and a persistent pandemic.

How can the market go up in such crazy times?

First and foremost, we believe the markets are forward looking and discount future expectations 9-18 months into the future. Simply put, the inflection point of bad economic experience from the shutdown appears behind us now. Hopefully we’ve already seen the worst numbers posted in unemployment and economic activity with the expectation that things get better from here. The data so far clearly backs this up with retail sales and employment yielding surprisingly good increases1.

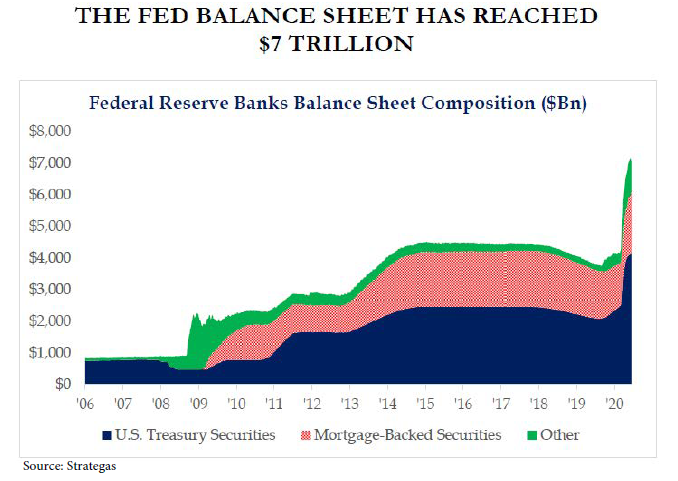

Secondly, maybe more importantly and certainly far less understood, we have massive Federal Reserve intervention and extremely low rates. It is on this point we wish to elaborate, as we feel this will be the dominating force over the short to intermediate-term in how the markets and asset classes perform from here.

The Federal Reserve has provided an unprecedented level of liquidity to the markets. They have bought US Treasuries and mortgages, as they have in the past, as well as initiated the purchase of fixed income ETFs (Exchange Traded Funds) and individual corporate bonds. This provides liquidity to the market, by buying assets from investors and replacing them with liquid cash. Cash is generally a low yielding, albeit safe yet wasting asset to the vicissitudes of inflation. Hence, investors generally seek to deploy cash once markets are calm and panic recedes.

This program of quantitative easing (QE), or purchasing of fixed income securities, can be thought of as an injection of cash to stabilize markets. Once the Federal Reserve has bought bonds from investors, leaving them with cash, those investors must reinvest those assets somewhere. However, the pool of assets available has now shrunk. So too has the return available to investors when rates go down. For example, the taxable yield of a 10-yr US Treasury is .65%, as of quarter end2, versus a longer term suggested inflation rate of 2%,locking in a guaranteed loss versus purchasing power. This is not an attractive outcome.

So, with increased liquidity provided to markets via Federal Reserve intervention and extremely low rates, which will likely yield negative or zero real returns, we believe investment capital is forced into risk assets to find attractive or acceptable real returns. And by “risk assets” we mean the stock market, hence why it is not so crazy to see the markets rise now that we seem to be past the worst of the economic data.

If the resulting 10-year bull market run post the $2 Trillion in stimulus in 2009 is any indication, we should expect that there is strong potential for the intermediate and long-term future from the recent stimulus. Coupled with the Federal Reserve Chairman suggesting that rates will stay lower for longer, in our opinion there really is no alternative to risk assets for those seeking real returns.

What do we think going forward?

We do believe that equities will likely have more volatility until we near the end of the global Covid Crisis, and we are steeled for that reality. Hence, we have been opportunistic and more willing to trade. We think having cash to implement will provide us the ability to be nimble and take advantage of volatility when it occurs.

We expect rates will not go negative in the US, and they will eventually rise from these record low levels. Therefore, long-term bonds and duration are not likely sources of return and may in fact be uninvestable. Hence, we favor holding shorter duration corporate and municipal bonds within our fixed income allocations and will not reach for yields by extending duration and maturities.

It appears right now there is a tug of war in investor’s minds relative to the debate between inflation and deflation. Though you see inflation bandied about in the financial press more, we believe deflation is the most historically correlated outcome to massive leveraging of the US balance sheet. We remain vigilant of either potential outcome but believe that deflation is the real short-term concern.

In the face of this we remain convicted in our belief that equities provide the best source of real returns, and cash yields via dividends, are preferable to any other liquid asset class available to investors. We think the equity market strength is rational and will likely continue, especially during an environment of record low interest rates and massive Federal stimulus. If we are wrong about deflation, we believe we still benefit because equities are one of the most resilient asset classes in the face of inflation.

We remain very positive on the long-term prospects for the US economy and its resilience. We are grateful for our client’s trust in our stewardship during these turbulent times.

John Cheshire

Chief Investment Officer

07/10/2020

Citations

[1] https://www.bls.gov/news.release/empsit.nr0.htm; census.gov

[2] www.strategasrp.com 7/1/20

Additional Disclosures:

Asio Capital LLC (“Asio”) is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. Asio may only transact business in states where it is properly registered or is excluded or exempted from registration requirements. The information contained herein is not intended to be personal investment advice or a solicitation to engage in a particular investment strategy. All investments and investment strategies involve risk. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Asio, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Asio. Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Asio Capital is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Asio Capital’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.