It’s hard not to reminisce about the Global Financial Crisis of 2008 – 09, while sitting at our desks reading headlines and trying to make sense of news flows. All the while, considering the very real implications to businesses who we have exposure to in both the debt and equity markets. Much like those crisis days, we find ourselves trying to remove businesses that may be fundamentally harmed from the portfolio and replace them with businesses that are more robust. During this process we are attempting to maintain, or even increase, our gearing to the upside. And much like we remember, the reality is ever evolving and changing, so both an open mind and nimbleness is required to prudently navigate these markets.

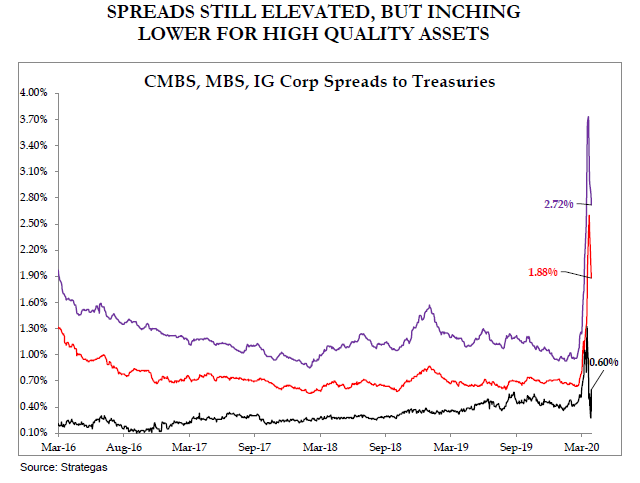

In the very early days of the 20th century, stock market corrections were generally referred to as “Panics”, and that word might be the most appropriate way to view the recent market events. This has been the fastest drawdown of the equity markets in history1. And much as we experienced in 2008 – 09, and even in December 2018, most everything is correlated on the downside. The disruption, or lack of liquidity, even affected municipal and corporate bonds as credit spreads widened to extreme levels in days as market makers tried to digest the implications from a creditor’s perspective.

There is much debate on whether we will experience a U-shaped recovery versus a V-shaped recovery. We do not have any clue, nor care much to speculate, how short-term events will unfold. We find it saner and more appropriate to simply look out to the intermediate future and how we will come out of this in a 3 to 5-year period. The multi Trillion-dollar stimulus to the economy, as well as low interest rates, will likely fuel a longer-term economic growth trajectory after we have experienced some normalization. As professional investing requires taking a long-term view, it is hard not to be very bullish looking at the future in the context of current equity prices.

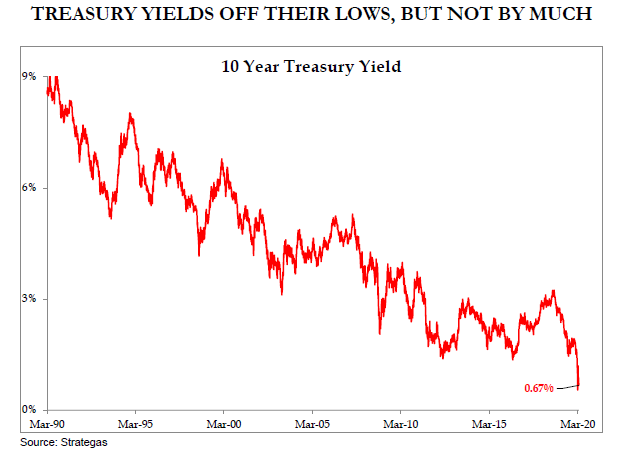

Much is being written on the potential inflationary effect of the stimulus. We would advise our clients to view that as a potentially more positive outcome than a deflationary experience. In fact, the lack of inflation since the last crisis, as well as the rising Government debt levels, would point to possible continued deflationary forces. In addition, the effects of technology can help to reduce living costs and improve living standards. We are hopeful for a contained and modest reflation, but there is no indication of that reality in the bond market. Though US Treasury yields may reflect fear more than they do inflation expectations at the current moment.

In fact, in the context of low interest rates and a likely low rate environment for the foreseeable future, it is very hard to argue that equity prices, real estate prices, and all risk based or interest rate sensitive assets are not woefully undervalued. If these assets are to be valued as an alternative to a risk-free rate of return, for example the 10-year US Treasury yield, they would have to be viewed as a table pounding buy. We believe much of future equity market returns will undoubtedly hinge upon how fast, and to what magnitude interest rates return to normal.

We are using the indiscriminate selling and irrational price disruption to reposition the investment portfolios in a way that we believe reduces the risks we face, as well improve future returns. We do fundamentally believe that market panics, disruptions or corrections, are where opportunities for long term profits most materialize. In the words of the great investor Shelby Cullom Davis, “You make most of your money in a bear market, you just don’t realize it at the time”.

We remain optimistic on the long-term prospects for both the US and world economies. We believe that the aggressive level of Government stimulus in the US economy makes it the best place to be invested at this time. We firmly believe that our focus on high quality business models and balance sheets serve to limit and control risk. We view the extremes in volatility, which unnerves many investors, to be beneficial in our ability to add value and improve returns.

We hope that our clients and their families will remain healthy and safe.

John Cheshire

Chief Investment Officer

4/8/20

Citations:

Additional Disclosures:

Asio Capital LLC (“Asio”) is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. Asio may only transact business in states where it is properly registered or is excluded or exempted from registration requirements. The information contained herein is not intended to be personal investment advice or a solicitation to engage in a particular investment strategy. All investments and investment strategies involve risk. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Asio, or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Asio. Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. Asio Capital is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of Asio Capital’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.