It can be a struggle poring over charts and data, trying to find something poignant, timely and with some punch at each quarters end. Sometimes new substantive material can be hard to come by, especially when the deafening roar of “news” from so many multi-channel sources saturates people with daily narratives, some true, and some contrived.

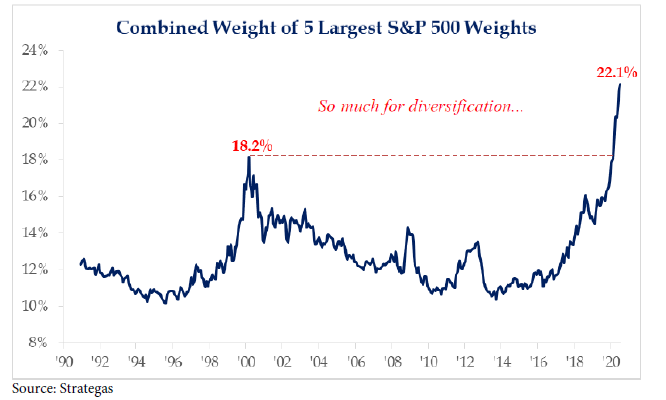

So, we find ourselves coming back to discussing the topics of the election, as well as the combined weighting of the five largest stocks (Apple, Amazon, Alphabet, Microsoft, Facebook) in the S&P 500, a point of narrative that we have discussed before.

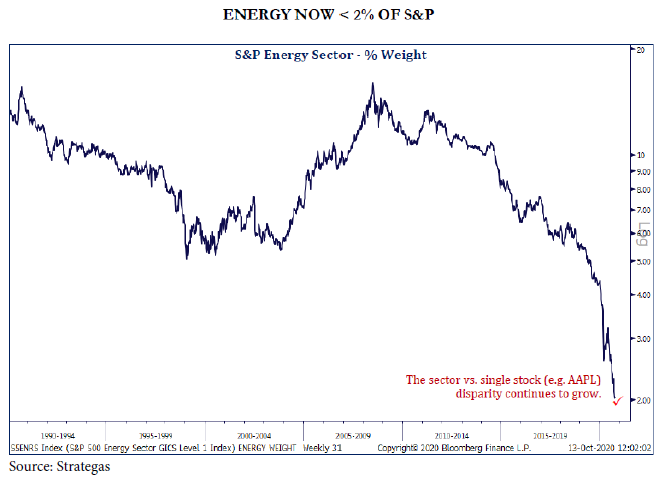

There is great irony in these two charts. At one time Exxon Mobil was one of the largest 5 weightings in the S&P 500. Now the top five is dominated by technology companies who have disrupted entire industries and emerged as powerful monopolies. Not in modern market history have we seen such a concentration of index weight in such a few companies. In fact, each of the five current largest individual companies are now larger than the entire Energy Sector.1

Low interest rates, and negative real rates (interest rates minus inflation rate), produce funny things in financial modeling. Most traditional financial modeling becomes distorted with zero rates. Growth, in financial equations used to model, becomes extremely valuable when discounted into the current zero bound alternative returns. And hence we have seen growth, and the perceived ability to grow, dominate the markets both in narrative and investment returns.

While we strongly believe that we are in a period of unprecedented disruption and change, we also believe the current market environment has severe distortions that will end up being corrected at some point. Many years ago, it was pointed out to us that there was not much difference between being too early and being wrong with an investment thesis. So, we will wisely not hazard a guess as to when a reversion will occur. But we see, as illustrated in the charts above, an extremely likely distortion. But the how, when, and why of any change to that distortion we do not think anyone can predict.

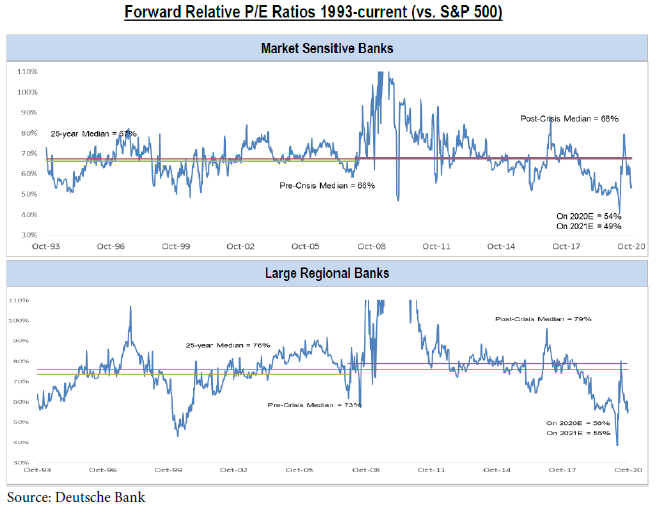

We have seen some of the distortions created or exacerbated by the novel coronavirus earlier this year already resolve themselves while others persist. Several sectors of the market such as Technology, Consumer Discretionary, Materials and Industrials have largely recovered from the selloff in March. While other sectors, like Financials, are taking longer to participate in the market rally, we have maintained our exposure to them. We do believe this is a distortion that will correct positively for owners of the sector and is not a reflection of reality. Simply put, we think banks are cheap, really, really, cheap. They are not in the same shape as they were in 2008-09 when they had too much leverage and were loose with lending standards. As a result of the Financial Crisis, banks are now extremely well capitalized and have much more rigorous lending standards and oversight.2 We believe things are not as bad as perceived and are both an opportunity and another great example of distortions we see in the markets.

We must admit the greatest distortion we see is the fear of the American people in the face of the most divisive election season that we recall. Depending on what “news” source one watches, the reporting of any event seems so drastically different than other “news” sources available. We no longer seem to have an impartial source of news which is agreed as true in any unified national way. The days of Tom Brokaw and Dan Rather are long gone. Depending on what flavor of news channel or social media you view, drastically different narratives are given. In fact, social media and search algorithms have produced a level of divisiveness we have not seen before, in our opinion.

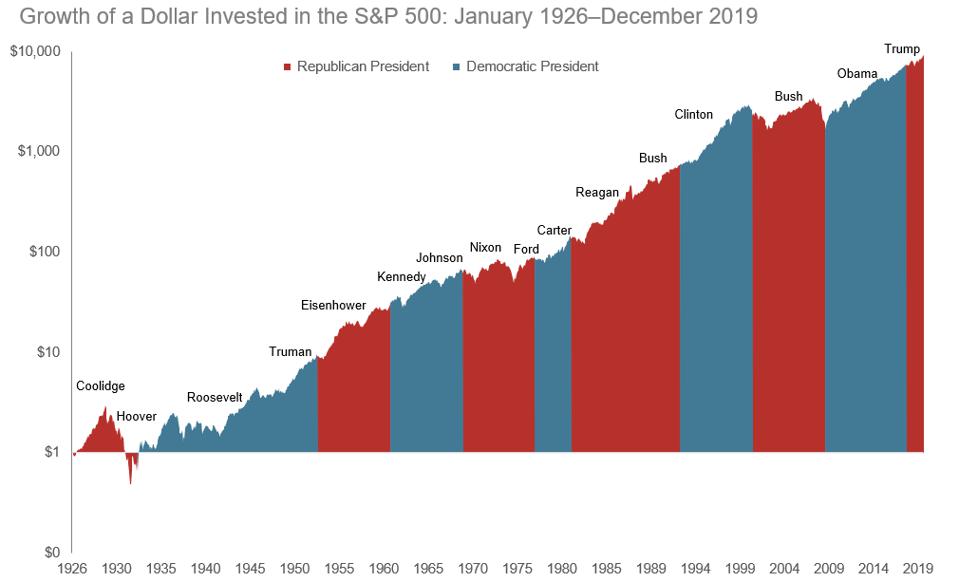

This is not the first election cycle fraught with high emotions and raw nerves, but markets do not pick sides. Sure, one party or the other can be perceived to be better for business, but the business cycle largely floats on its own tide, impervious to hues of red or blue. Over time, equity prices have typically climbed regardless of who occupied the Oval Office.3

Thus, we separate politics from our investments. But this is what we believe, based on the rich historical data – It does not matter to the market who is President. From our perspective, long-term returns will continue to be similar to past returns we have experienced. The squiggles of daily price movement will be different. There may be drastically different sector returns and individual security returns. But, we believe, general asset class returns will remain constant.

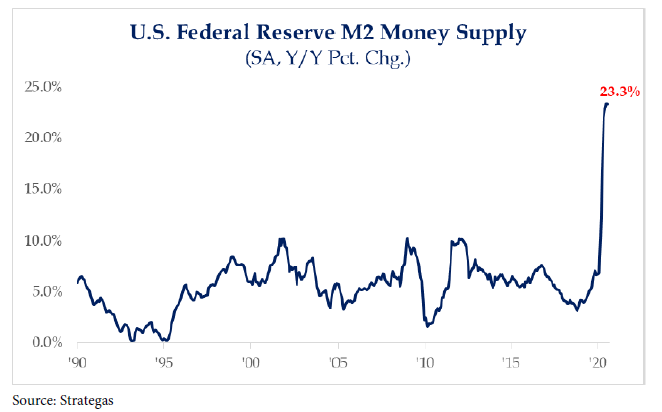

We expect any combination of Presidential and Senatorial election results will lead to additional monetary stimulus. We also expect increased balance sheet and deficit spending regardless of the party in power. Rates will likely stay low for longer than many imagine, and deflation is as much of a risk as inflation. Our beliefs are squarely in the short-term deflation, long-term reflation camp. However, we are also keenly watching economic data for any sign of a change to that thesis.

Given the extreme amount of stimulus and low interest rates, stocks should continue to be attractive, albeit with some episodes of volatility. We think an attractive place in the market is stocks with above average dividend yields since these may prove to be a very appealing income source while rates remain low.

Keep in mind, our investments in stocks represents our outlook for those companies over a multi-year period. Do not allow short-term market movements driven by the latest headline to create angst. We think that there will be significant growth ahead, and a multi-year expansion resulting from the extraordinary amount of stimulus that has been, and likely will be, injected into the US economy.

John C. Cheshire

Chief Investment Officer

10/14/2020

Citations

1. https://www.investopedia.com/top-10-s-and-p-500-stocks-by-index-weight-4843111

2. https://www.fdic.gov/regulations/capital/capital/community_bank_guide_expanded.pdf

3. https://www.forbes.com/sites/kristinmckenna/2020/08/18/heres-how-the-stock-market-has-performed-before-during-and-after-presidential-elections/#5cebaa404f86

Additional Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2010-1