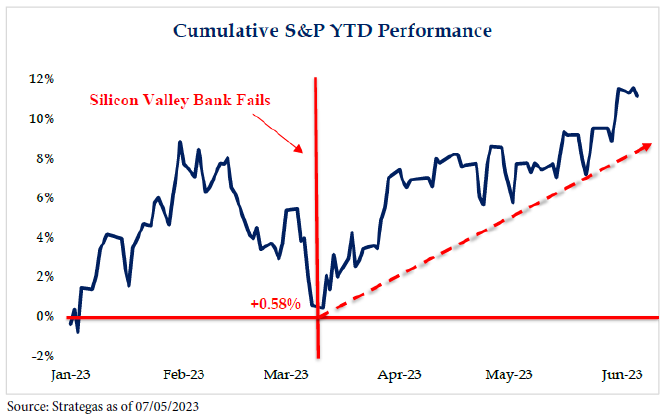

While mania and panic often follow one another, it’s difficult to recall experiencing both in one quarter, such as we did in the second quarter of 2023. From the regional banking crisis to the current artificial intelligence (AI) mania, during the quarter the market swung from fear to elation. We have several dispassionate opinions on these issues and a few of us here at Asio Capital date back to the last banking calamity during the 1980’s and 90’s, the Savings and Loan (S&L) crisis, which cost taxpayers an estimated $124 billion.1 This period was followed by what the former chair of the Federal Reserve, Alan Greenspan, coined the “irrational exuberance” of the mid-1990’s.

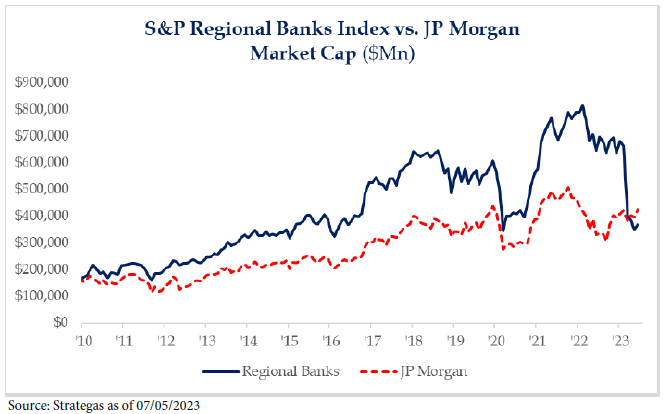

First, the regional banks and their rumored obsolescence. We do not believe the regional banking system is going away but would expect smaller institutions to be challenged. Deposit insurance limits likely need to be revisited and revised due to the incredible ease of moving money. Having a diverse and robust banking system in the United States helps avoid the concentration of systemic risk and makes our system more structurally sound. Small and medium size banks also are critical to lending and keeping our economy vibrant. The chart below illustrates the sentiment towards regional bank stocks. The country’s largest bank, JP Morgan, has a market cap greater than that of the entire regional bank index.

With regards to artificial intelligence (AI), it has been unfolding for some time now, but only more recently has become the center of attention. The evolution of large language modeling via products like ChatGPT, Bard, and Bing is the most recent chapter to be written. This new technological shift will be immense in its importance to productivity and our broader society. The AI mania has led to many investors chasing hot story stocks, which is merely a first order effect of the mania.

Looking forward, we are thinking through the second order effects and which companies may be the less obvious beneficiaries of AI. AI should provide many benefits from improved productivity, accelerated scientific advancement as well as margin improvement for those companies who successfully implement it. These benefits should have a positive impact on economic growth and potentially improve living standards. The speculative money chasing AI names today have driven up valuations in the short-term, which is leading our team to be selective and patient as we’d expect there to be ample opportunities over the coming months and years to invest in this long-term, secular growth story.

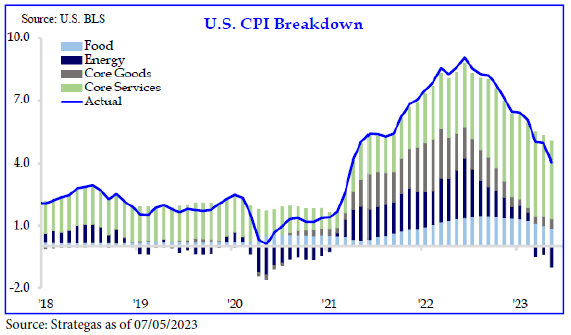

As we look back on the quarter ended 6-30-2023, it was a better quarter for risk assets. Positive catalysts included the debt ceiling resolution, the banking system finding its footing as deposit outflows slowed, and the continued strength in the labor market. Inflation continued to decelerate, but does remain well above the Federal Reserves desired target of 2%. Given the persistence of inflation, the market is expecting the Fed to raise interest rates an additional 0.25% at the July meeting and potentially further at future meetings.

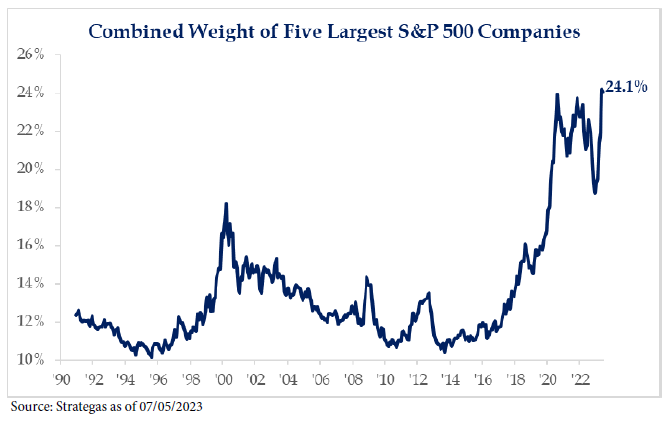

One of the most distinct traits of the market year-to-date has been the concentration of investors and the index composition in a small subset of stocks, predominantly technology stocks. The top 5 stocks in the S&P 500 (Apple, Microsoft, Amazon, Nvidia, and Google) account for 24.1% of the total market cap. 2 Furthermore, these 5 stocks drove nearly two-thirds of the return of the S&P 500 through June 30th, 2023.3 This concentration is both befuddling and worrisome for investors as historically this level of concentration is not sustainable. Our approach has been to continue to build diversified portfolios and seek to take advantage of opportunities offered by the market. Examples of areas where we believe we continue to identify value are cyclical stocks, such as energy and industrials, small cap equities, and high-quality fixed income.

Challenges and questions certainly remain as we move into the second half of 2023. How much further will the Fed go? How long can the consumer hang in? Will corporate earnings continue to beat expectations? All these are tough questions to answer, but we remain encouraged by the resiliency of the labor market and consumer. The Fed has come at the consumer with a flurry of body blows via higher interest rates, but the consumer continues to hold its ground. While it’s fair to expect volatility to persist into year end, we believe our focus on quality and risk management should allow our team to take advantage of the inevitable dislocations in the market.

As always, it’s a pleasure to serve you and we appreciate your trust. Have a safe, healthy end of summer.

John Cheshire

Chief Investment Officer

Bryce Goldbach

Portfolio Manager & Wealth Strategist

07/12/2023

Citations

[1] https://www.federalreservehistory.org/essays/savings-and-loan-crisis “Savings and Loan Crisis”

[2] www.strategas.com “Quarterly Review in Charts Wed. July 5, 2023”

[3] www.gs.com/research/hedge.html “US Quarterly Chartbook as of 6 July 2023”

Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

The companies identified above have been selected to help illustrate the investment process described herein. This information should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the companies listed have been or will be profitable, or that investment recommendations or decisions we make in the future will be profitable.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2307-01