Order of magnitude, which is an exponential change relative to a value or quantity, is often difficult to conceptualize. The world functions logarithmically, but as humans we are programmed to think linearly. To fully appreciate the effect of rising interest rates and the impact on markets, it’s helpful to consider the magnitude of the change in rates.

Parallels to inflation experienced in the 1970’s-1980’s are often referenced by the press and media. If we turn back the clock to May 1975, the Federal Funds rate was at 5.2%. Four years later, in May of 1979, it was 10.2%, an increase of approximately 96%.1

When it became evident that inflation was a problem fueled by actions taken during the Global Pandemic, the Federal Reserve (Fed) hiked rates 0.25% in March 2022. Following the March meeting, the Fed would continue to raise interest rates to their current levels of 4.75 – 5.00%, as of March 31, 2023. The magnitude of this twentyfold or 2,000% increase, especially in such a short period, has no historical precedent. 2

During a typical interest rate hiking cycle, pockets of stress start to emerge in the economy. Stuff simply begins to break, and we observed a few instances of this during the first quarter of 2023. The 2nd and 3rd largest bank failures in US history occurred in March with Silicon Valley Bank and Signature Bank, respectively. While certainly there is a more technical explanation, we believe the root cause of these failures was both banks took on too much risk. When the banks needed liquidity, they had to sell bonds with low yields and long-dated maturities, which led to significant losses. This called into question the health of the banks and a loss of confidence in them, which led to a run on their deposits, and the demise of both institutions.

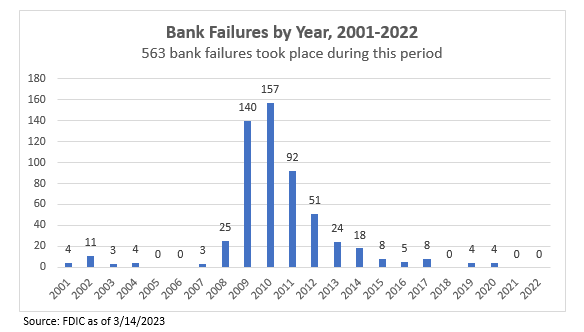

The size of these failed banks makes them notable, which helps explain why various measures were taken to protect depositors of these institutions and more importantly reinforce confidence in our banking system. However, it’s important to recognize bank failures are not abnormal. If we look historically, having banks fail is not uncommon. We believe the failures in March by Silicon Valley Bank and Signature Bank are more idiosyncratic than systemic as we view the banking system generally as well capitalized. High levels of leverage coupled with falling asset prices as they are discounted to a new rate environment is a disastrous combination. More will likely break, but we’d expect it to be outside of the banking system.

As we evaluate other potential risks, areas that come to mind are companies who have high levels of leverage or floating rate debt and may need access to capital when lending standards are tighter, and rates less favorable. There often are second-order effects that can spread beyond the more obvious points of distress. Our approach is to constantly assess and reassess our portfolio to eliminate exposure where we do not believe we are being compensated for the risk taken.

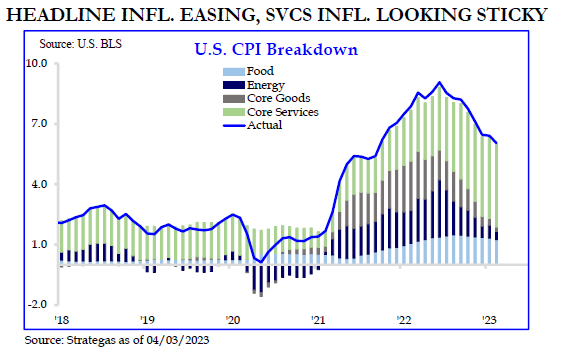

The good news is that we are likely close to the end of the tightening cycle. We believe, the stress on the balance sheets of the banks certainly is an input the Fed will consider as they approach the May and June meetings, but more importantly we are seeing inflation continue to roll over. The Consumer Price Index for March was 5.0%, still above the Fed’s target of 2.0%, but well below the pandemic peak of 9.1%.4 Having more clarity on rates may ease some of the fragility and volatility that investors have experienced over the last 12 – 15 months.

The Fed has signaled a desire to hold rates higher for an extended period. Combining this with tighter credit conditions from bank lending, it’s fair to expect economic growth to continue to slow. While a recession is certainly possible, we would expect a shallow recession given the health of the consumer and corporate balance sheets.

Below are a few brief thoughts on what’s most interesting to us in this environment:

- Equity markets are forward looking. When it’s clear the tightening cycle is nearing its conclusion and the economic cycle may be bottoming, returns typically improve as market participants shift from discounting the recovery to anticipating the next expansion.

- Fixed income, which provided anemic streams of income in the zero-interest rate environment, is now providing a real rate of return. We find short to intermediate bonds attractive, as well as short-term treasuries for cash management.

- We believe volatility continues to provide investment opportunities. Examples include the Energy sector, where demand remains healthy from the consumer and the US must replenish its depleted strategic oil reserves. We also see value in Industrials, where onshoring and deglobalization should be a tailwind and International equities, where valuations appear to be attractive.

As we look forward, we remain excited about the opportunities presented to us and are focused on managing risk across our portfolios. As always, we thank each of you for the opportunity to serve you and wish you a happy and healthy Spring.

John Cheshire

Chief Investment Officer

04/13/2023

Citations

[1]https://fred.stlouisfed.org/series/FEDFUNDS “Federal Funds Effective Rate”

[2]https://www.forbes.com/advisor/investing/fed-funds-rate-history/ “Federal Funds Rate History 1990 to 2023”

[3]https://www.fdic.gov/bank/historical/bank/ “Bank Failures in Brief – Summary 2001 – 2023

[4]https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical_us_table.htm “Consumer Price Index Historical Tables for U.S. City Average”

[5]www.strategas.com “Quarterly Review in Charts Mon. April 3, 2023”

Disclosures

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Treasury yield is the return on investment, expressed as a percentage, on the U.S. government’s debt obligations.

It is the effective interest rate that the U.S. government pays to borrow money for different lengths of time.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2304-01