“Forecasts create the mirage that the future is knowable.” -Peter Bernstein, Economist1

Thirty-eight economists were polled by Bloomberg mid-December 2022 and asked to share their forecast on the odds of a recession in 2023. Seventy percent believed the US would enter a recession in 2023.2 This poll, while only one measure, was reflective of a view across the industry that a recession wasn’t a matter of “if”, but “when”, for 2023.

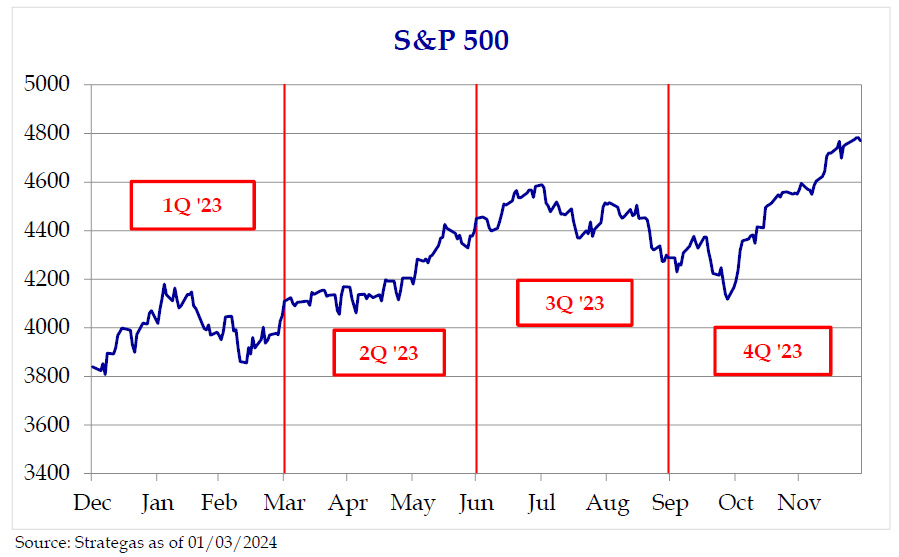

Fortunately for investors our industry is terrible at forecasting, no recession surfaced, and 2023 turned out to be an excellent year for risk assets. Only one asset class – commodities – provided a negative total return for the year.3 Stocks, as measured by the S&P 500, returned +26.29% (including dividends) and the Bloomberg US Aggregate Bond Index, the most recognized fixed income index, returned +5.53% in 2023.3

So, what potentially did economists, strategists, and investors get so wrong about 2023?

- 2022 was a year to forget for investors and likely the extrapolation of the negative sentiment in 2022 played a role in shaping the bearish mindset for many going into 2023.

- In the face of the Federal Reserve (“the Fed”) raising interest rates from 0% to north of 5%, the labor market and the consumer proved to be incredibly resilient.

- The lack of interest rate sensitivity from corporations and consumers was underappreciated. US corporations did an excellent job terming out their debt at low rates and consumers locked in historically low mortgage rates on their homes.

- Lastly, it would be remiss to not mention the hype around artificial intelligence and the impact that had on certain stocks, including many of the largest technology stocks.

2023 was not all smooth sailing, however, as investors had to show great fortitude at times. Notable challenges investors faced included the Silicon Valley Bank Crisis in March, war and geopolitical conflict around the world, the inability of our elected officials to reach consensus on important issues impacting the American public, and a spike above 5% for long interest rates during the 4th quarter.

Entering 2024, we believe there are numerous reasons for investors to feel optimistic about the year ahead as it relates to improving market breadth, a potential shift in monetary policy by the Fed, and the election year phenomena.

A healthy development has been the improvement in market breadth. In our second quarter 2023 newsletter (“Crisis to Mania”) we drew attention to the S&P 500 Index being top heavy. For much of 2023, the performance of the equity market was driven by the 10 largest stocks, which as recently as October 31st, 2023, accounted for 124.3% of the index performance through the first 10 months of the year. 5 Meaning, most other stocks had flat to negative returns. The last two months saw market participation broaden and laggards for the year, such as financials, start to carry the baton and lead.

Inflation also continues to show progress, trending back towards a more comfortable level for the Fed. This may allow the Fed to ease monetary policy in 2024 through rate cuts. At the Fed’s December meeting, they signaled that they anticipate 75bp of interest rates cuts in 2024. This differs from the more aggressive view the market has of roughly twice that many cuts. 6 More interest rate cuts potentially could be supportive of higher valuations for stocks, but fewer interest rate cuts may not necessarily be a bad outcome if fueled by better economic growth.

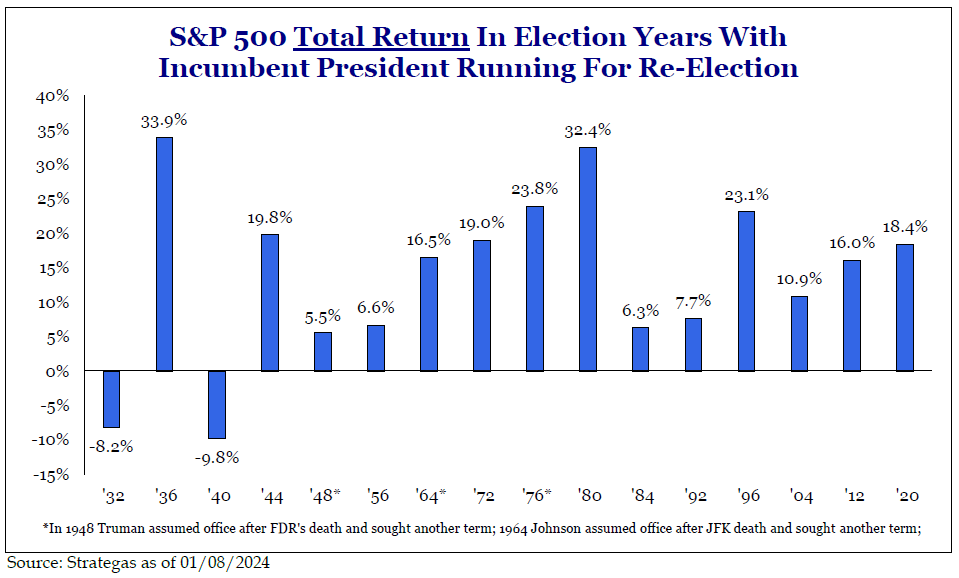

2024 is also an election year where it is likely that we will see a rematch of incumbent President Joe Biden and expected Republican nominee Donald Trump. Election years are unique because the typical path of returns differs from a typical year in you often see weakness early in the year followed by a second half rally as there is less uncertainty as to who may be running and/or the potential outcome. A reason to be optimistic is that if you look back to 1944, the S&P 500 Index has had a positive total return in 16 of 16 years where a president is in a re-election year. 7

It’s customary around the last few weeks of December each year to have our inboxes jampacked with outlooks for the year ahead shared from research partners of ours across the industry. While it’s always helpful to read the wisdom of the many incredibly intelligent practitioners in the business, it’s important to our team here at Asio Capital to remember the limits of forecasting that the late Peter Bernstein alluded to in the opening quote. We find it critical to have our process be rooted in fundamental research, risk management, and diversification, which we believe provides the foundation for success over the long-term.

One of our favorite quotes is from Howard Marks, co-founder of Oaktree Capital, a large alternative asset manager. Marks said “You can’t predict. You can prepare.” 8

As we look optimistically to the new year, we are grateful for our many blessings and the clients we are so fortunate to serve.

Bryce Goldbach

Portfolio Manager & Wealth Strategist

01/10/2024

Citations

[1]https://www.bloomberg.com/news/articles/2022-12-20/economists-place-70-chance-for-us-recession-in-2023

[2] https://www.bloomberg.com/news/articles/2022-12-20/economists-place-70-chance-for-us-recession-in-2023 “Economists Place 70% Chance for US Recession in 2023”

[3] https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/market-updates/weekly-market-recap/ “Weekly Market Recap – Week of January 8, 2024”

[4] www.strategas.com “Quarterly Review in Charts Wed. Jan. 3, 2024”

[5] www.strategas.com “5 Charts for Client Letters Thursday, January 4, 2024”

[6] Goldman Sachs “US Daily: December FOMC Recap: A Faster Return to the 2% Target Means Faster Cuts (Mericle)”

[7] www.strategas.com “2024 Policy Themes Mon. Jan 8, 2024”

[8]https://www.oaktreecapital.com/docs/default-source/memos/2001-11-20-you-cant-predict-you-can-prepare.pdf “Howard Marks Memo – You Can’t Predict. You can Prepare.”

Disclosures

This report was prepared by Asio Capital, a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Form ADV Part 2A & 2B can be obtained by visiting https://link.edgepilot.com/s/849e5eac/xrcqBzdw_UKkcOoJYdvT8g?u=https://adviserinfo.sec.gov/ and search for our firm name. Neither the information nor any opinion expressed it so be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice. This is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

S&P 500 measures the performance of 500 widely held stocks in US equity market. Standard and Poor’s chooses member companies for the index based on market size, liquidity and industry group representation. Included are the stocks of industrial, financial, utility, and transportation companies. Since mid-1989, this composition has been more flexible and the number of issues in each sector has varied. It is market-capitalization weighted.