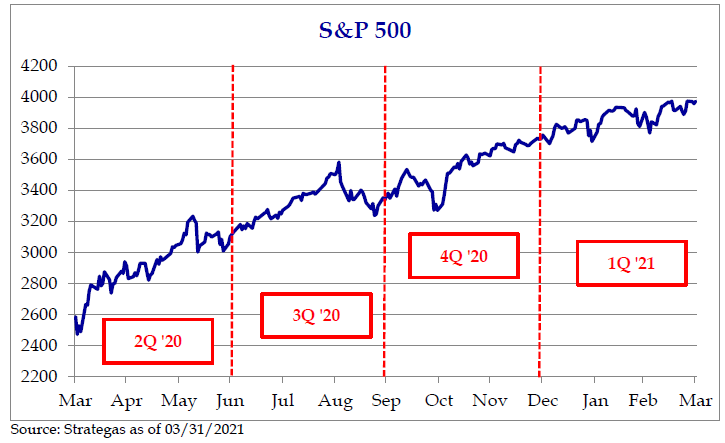

What a crazy twelve months we have had! Almost unbelievable, from the pandemic lows to new market highs. In fact, after the March 2020 lows, it has been a straight uphill climb for the markets. We now find euphoria replacing the rampant fear of the pandemic.

Markets tend to be as emotional as they are financial. They often reflect our psyches as much as business prospects and results. We believe we have all experienced an economy that was much stronger and more resilient than most believed as we entered the early stages of the pandemic. Also, the massive injections of liquidity by the US Government have added fuel to the economic fire.

We find ourselves, as investors, trying to look forward and figure out where to invest, as opposed to looking backward to create explanations for the seemingly random events that happen in our lives and the markets. For this quarter, we know there will be much ink spilled in investment quarterly letters over narrative and celebrating the upward momentum of equities we have seen.

We wish instead to talk about the world as we look forward, as we think there are significant structural changes, that as investors, we need to critically ponder. Though we frame this from the US perspective, we believe it could be a more global phenomenon, as growth spreads worldwide and global interest rates begin to reflate.

Interest Rate Environment

We have had a nearly 40-year experience of falling interest rates. We now believe that the falling interest rate environment has shifted to one of generally long-term rising rates.

In fact, as we saw the 10-year U.S. Treasury yield nearly double, quietly from .87% to 1.70% in the first quarter of 2021, where bond investors may have experienced quarterly losses they were not accustomed to encourntering.1 Simply put, when rates go up and yields rise, bond prices go down. And from our observation, they go down more substantially as the duration, or length of maturity, increases.

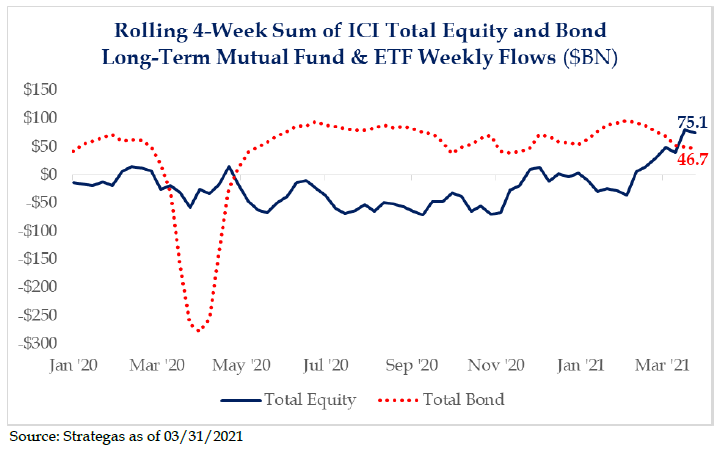

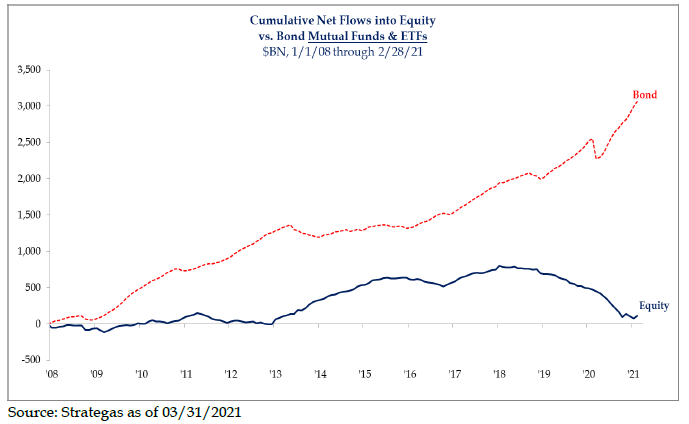

For investors in longer dated bonds with low rates, the effects of rising rates can be meaningful. In fact, we have begun to see this play out as market flows have started shifting. Flows into bond funds are on the decline, while equity inflows have begun to rise.

This is after a decade of significant inflows into bonds versus stocks. We think this may begin to moderate going forward, if the interest rate environment looks more like the Post World War II environment than it does the period from 1980 forward. This is the thesis that we are beginning to operate under as we look forward and think about investment positioning.

Economic Stimulus

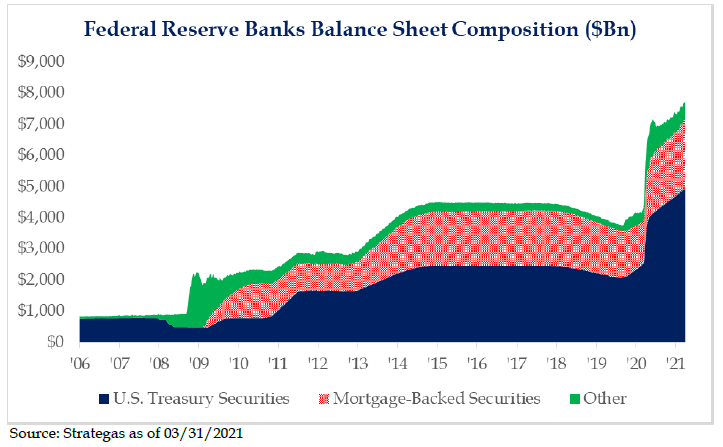

A trillion here, a trillion there, and all of sudden you are talking real money. Most living investors have never seen this level of massive liquidity injection into our economy. The closest time in history we can think of was during World War II, which was primarily fiscally focused stimulus. For perspective, the Federal Reserve increased its balance sheet by nearly 90% in 2020, and now we have nearly 1.2 trillion to be distributed under pending legislation, as well as massive fiscal spending proposed for infrastructure.2

No one knows what the outcome of all the liquidity, coupled with current low interest rates will be. Regardless, it has us believing that we will see economic growth that is likely much higher than most people expect. The second derivative of this is earnings growth, which we would anticipate exceeding expectations. Unfortunately, it may have the potential to set off another period of inflation.

We believe there may be second order effects that are not easily understood or modeled and will be evident in consumer behavior, technological disruptions, and in the general economy.

Inflation

Several questions on many investor’s minds are: Is inflation going to be a future problem? Are we entering a period of rising inflation and commodity prices? Or have we experienced a one-time jump in price levels due to the huge fiscal stimulus? For example, the price of a home increased 17% year over year, according to Redfin’s analysis of MLS data. 3 Was this a one-time pop in housing prices or the start of a trend?

We see collectibles rising in price, along with cryptocurrencies and oil and gas prices. Are these a result of a bottleneck in the economy or are they from speculation, or are these phenomena the start of a long-term trend?

The counterargument to inflation is the deflationary effects the advancements in technology have provided. We believe the massive deflationary force of technology will continue to exert force upon inflation moderating it, as well as raising general living standards and conditions globally. It is hard to overestimate the effect of technology deflation in our opinions.

However, for the first-time in recent memory we are worrying about inflation and the effects of the stimulus to economies worldwide. We find ourselves looking at commodities, and commodity stocks with interest for the first time in many years. This is a topic we will be watching closely and may likely impact investment allocations in the future. The answer to the question on inflation’s duration also influence how we think about interest rates and assets that price off them.

Looking Forward

“All models are wrong, some are useful” – George E.P. Box

We find ourselves considering both the headwinds of rising rates and the tailwinds of massive stimulus. Generally, we believe in rising rate environments you want to be short duration in your fixed income exposure and avoid interest rate sensitive assets such as commercial real estate, which we think may also see demand destruction.

The massive structural changes in our functioning economy will likely make technology and disruption a key theme for investors to be acutely aware of and positioned for. In our opinion, the world of 5G, the Internet of Things, autonomous self-driving, electric cars, and artificial intelligence will have wide and long-lasting effects on many industries and provide appealing investment opportunities. We believe the creative destruction is accelerating and threatens static portfolios or static ways of thinking about markets and the economy.

It is very hard to be bearish when looking at all the excess liquidity being pumped into the system, but then after the huge record setting market run we had over the last 12 months we believe it is rather hard to be wildly bullish, especially in looking at valuation levels. From our perspective, the potential for proposed higher taxes cannot be seen in any bullish light, but then the proposed infrastructure spending cannot be seen in any bearish light.

We talk to a lot of investors and portfolio managers, about how to build a playbook for the current macro backdrop. We would be most apt to look at the post War World II period of rising rates and an economy which had experienced a high level of stimulus. If this model were to prove correct, it would be good for stocks and bad for bonds. It appears to us, that scenario will likely be the longer- term thesis to operate under moving forward.

We remain positive about the US as well as the global economy. We expect markets will experience volatility and may currently be a bit overbought or overdue for a normal pullback. We are watchful about the potential for inflation and are optimistic for a good remainder of the year.

John C. Cheshire

Chief Investment Officer

04/15/2021

Citations

[1] www.strategasrp.com 04/05/2021

[2] www.strategasrp.com 04/06/2021

[3] https://www.redfin.com/news/housing-market-update-pending-sales-growth-stalls/

Additional Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-20104-1