Bull markets are a lot more fun than bear markets. This has been an understatement in 2022. Though bear markets are normal events, we have had our share of market declines over the last 4 years. The violent correction in the 4th quarter of 2018 was fast and quick. The Covid panic of 2020 was also a true extreme and happened very fast. While bear markets are normal and healthy, it would have been nice for investors to have a bit more time between the sharp downdrafts.

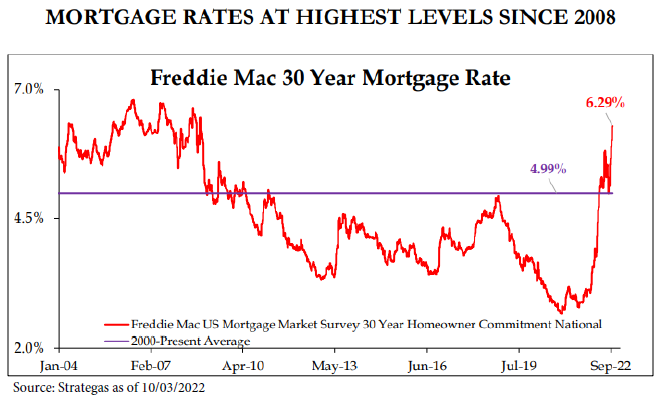

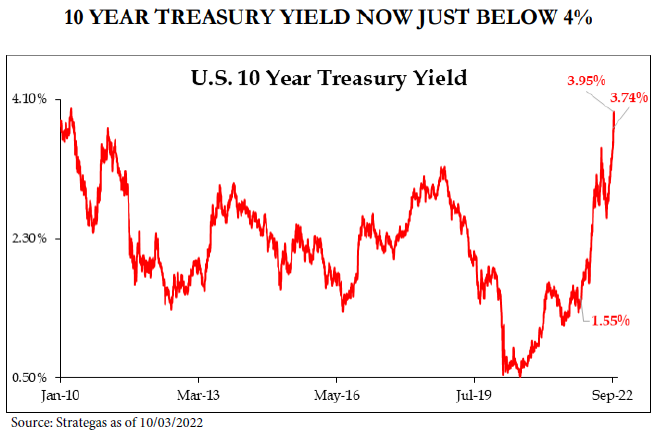

Over long data sets, one of the best inflation resistant assets has proven to be stocks. Yet, they react in the short-term to rising interest rates, as earnings get discounted back to a risk-free rate of return, which is determined by bond yields. Never have we seen as investors this fast and violent of a move in interest rates. For example, mortgage rates went from the 2.5% range to the highest rate in over a decade, in just 3 quarters. As this is being written, the 30-year mortgage rate hovers around 7%, and the 10-year US Treasury around 4%.

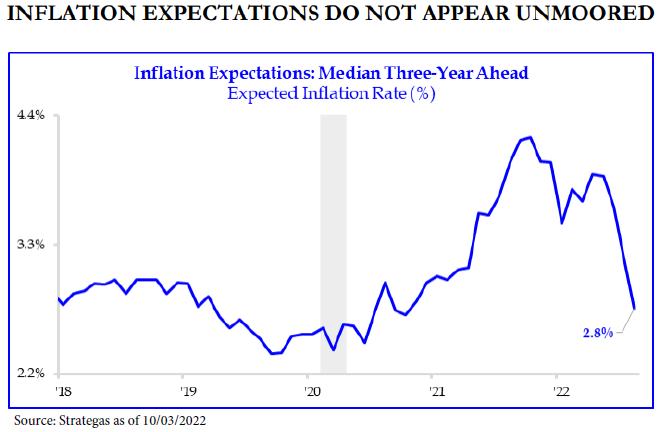

The effect of rising rates is a tightening of financial conditions and acts as a brake on the economy. Though in our view a rather crude tool, it is the primary lever the Federal Reserve has at its disposal. The Federal Reserve is trying to slow inflation in housing prices and rents, a major component of the Consumer Price Index (CPI), as well as energy prices, and rising rates have begun to work. We have seen gas prices peak, housing has begun to soften, and inventories have begun to rise. In fact, it appears that future inflation expectations are beginning to fall.

Much of the “inflation” we have experienced to date may have been more structural from Covid and underinvestment, than financially engineered. Supply chain disruptions, underinvestment in hydrocarbon development, and a shortage of housing combined to be what appears the perfect inflationary storm. The good news is that these are also catalysts for the next economic expansion, which is likely to be given a tailwind by new investment in energy, housing, and new supply chain sources.

The bad news is that the Federal Reserve tends to overshoot. Monetary policy has historically had a longer tailed economic effect, with interest rate changes taking 12 to 18 months to work their way through the economy. In other words, being only 3 quarters into the tightening of financial conditions it may take longer before we see the end to this bear phase of the market.

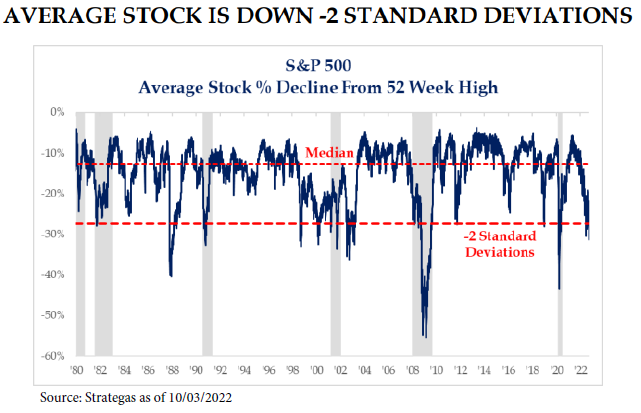

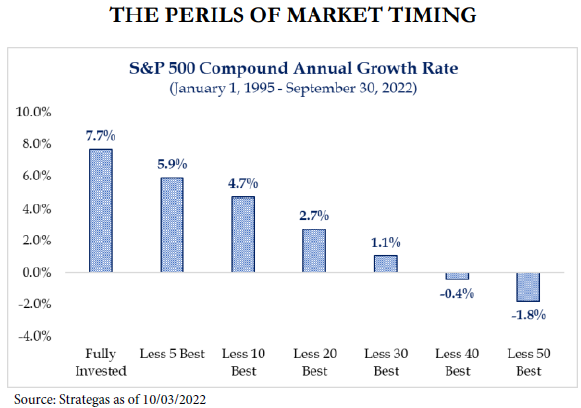

This begs the question of why should investors bear the pain of staying invested? It is simply this, if we look at a long-term chart of markets, they go up over time, and at returns that are very attractive historically. But more importantly, investors are horrible at timing. Bear market rallies and reversals tend to be violent. The recoveries we experienced in 2018 and 2020, in our view, are great examples of markets that snap back quicker than investors expect, especially at the darkest moments that characterize a market bottom or an extreme in negative sentiment.

With stocks already down what we feel is a rather extreme amount, we should be much closer to the bottom than the top. If “buy low and sell high” still applies, then this market level is in our opinion “low”.

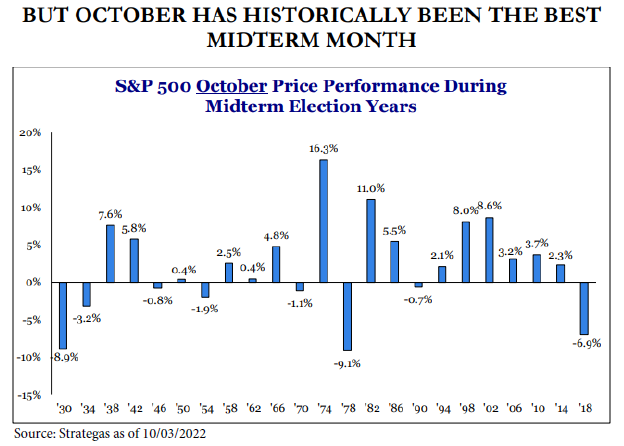

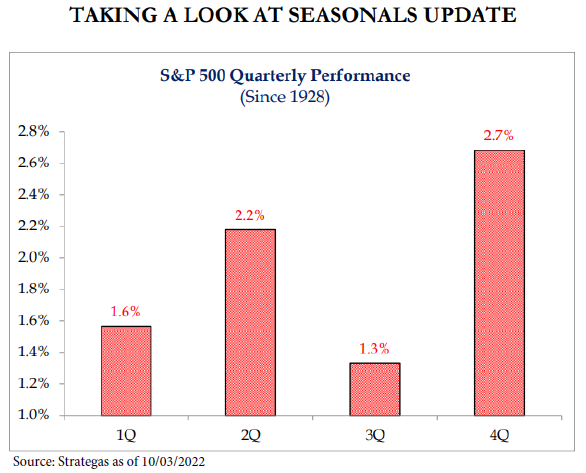

Since we write this during October, and having endured a very uncomfortable September, we want to close with a positive note for investors. September, in general, is not a good month for historic returns, but this appears to be especially the case in midterm election years. October has historically been much better in those years. Also, note that 4th quarter has traditionally been the best quarter of the year. We remain very positive for long-term returns, and an ending to this grueling bear market, and a reprieve in the next few months for investors.

John Cheshire

Chief Investment Officer

10/16/2022

Citations

[1] www.strategas.com “Quarterly Review in Charts Mon. Oct. 3, 2022”

Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

Treasury yield is the return on investment, expressed as a percentage, on the U.S. government’s debt obligations.

It is the effective interest rate that the U.S. government pays to borrow money for different lengths of time.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2207-01