Don't Panic

It is tradition to name boats, and there is a tremendous amount of creativity and humor that can be found in the names. Among our favorite, which has been seen in several states on a surprising number of boats, is “Don’t Panic” written upside down indicating you can read it when capsized.

This concept perfectly captures our sentiment after one of the fastest two-day corrections we have ever witnessed. Uncertainty in general is high, and sentiment surveys of Policy Uncertainty are off the charts high, begging comparisons to 2020 market sell off extremes.

It would appear that the administration seeks to reset the terms of global trade by use of blunt force trauma. We believe this is a potential negotiating tactic and/or stance to begin the process from an extreme position.

Regardless of how this plays out, we do not have enough information on what the resolution will be, nor its effect on the economy and corporate earnings to thoughtfully reprice security values. The market’s behavior seems to be motivated by irrational fear rather than actual earnings and economic data. Simply put, we aren’t ready to engage in a narrative of recession nor protracted global trade war, without more time and data to gauge the outcome and effect.

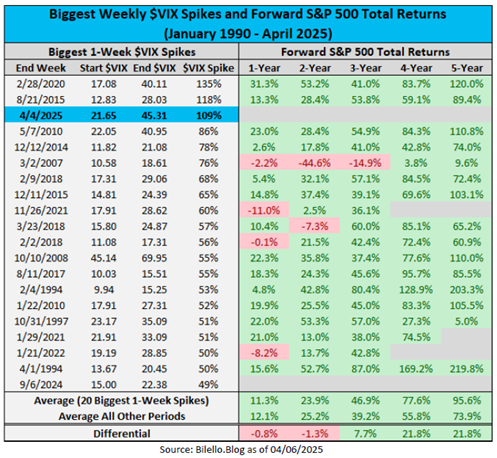

When we look at the history of forward equity returns after similar 2 day sell offs and volatility spikes as measured by the VIX, we note that past extreme sell offs of this approximate magnitude have given us very attractive forward returns. As such, we remain optimistic about the resolution and buyers of the dip till proven otherwise.

John Cheshire

Chief Investment Officer and Founder

04/06/2025