Is the inflation we are experiencing transitory? Or have we started a new era of inflation? We think this is a question that should be on investors’ minds as they consider investment positioning, asset allocation, and how to think about long-term returns. We believe there may be an element of truth to both stances.

The global economic shutdown due to Covid has no modern historic precedent. We have never seen a complete shutdown of the supply chain, nor an attempt to restart it. In an era of Just-In-Time production, inventories were seen as inefficient. Now, we are rethinking this approach around the world.

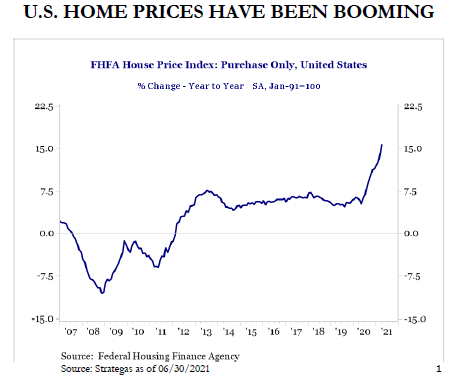

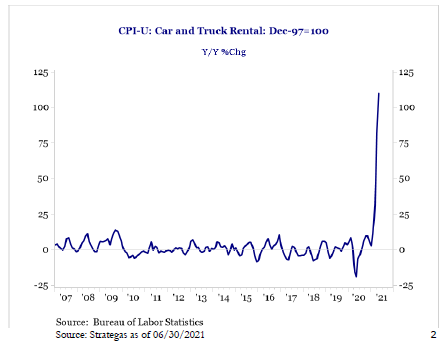

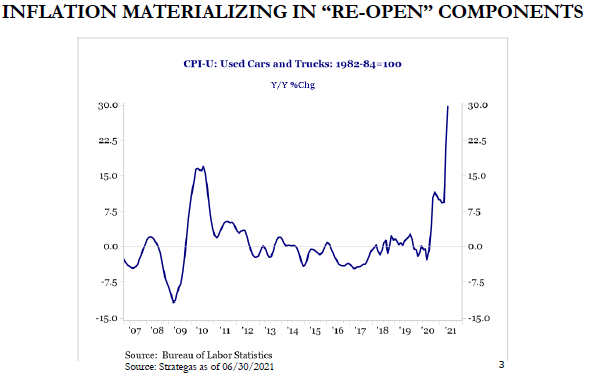

Cars, houses, lumber, rental cars, semiconductors and even food prices are rising as we deal with shortages of these items. Shipping bottlenecks, production backlogs and lack of supply have all caused a sudden run up in prices across the spectrum.

With time, we believe much of this will be resolved and there will be a normalization of pricing. We may see some increase in cost, versus past price levels, but we believe prices may fall from their peak. This is illustrated in the chart below of lumber prices year to date.

We think that prices may begin to slowly inflate from their corrected price levels. Or rather, that the distorted pricing will revert, before growing at a faster pace than we have experienced in the past decade.

This is especially true for commodities. However, it should be noted we think this concept should exclude labor inflation as it could be real and just starting. There is a shortage of workers across multiple industries. It has been in our experience that labor costs do not rise and fall in the way commodity prices do. Rising labor costs in an inflationary period are normally real and sustained in our opinion. Though labor costs have been flat to weak for many years, it appears this component of long-term inflation could be real and sustainable in the future.

Are we predicting runaway inflation? No. However, we believe this could be the beginning of a period of slightly elevated inflation. We are positioning the portfolio to be prepared for it from an investment stance.

One must not underestimate the strong deflationary effect of technology and its subsequent disruptions. We believe this continues in the future, making the inflation we expect to experience, occur primarily in businesses where there are high inputs of labor and commodities. But not where the benefits of technology make goods and services cheaper for consumers.

The likely investment outcome to our view is that both bonds and cash will have a negative real rate of return, making it a punitive holding for investors looking to buffer volatility. The Federal Reserve has intimated that they will let the economy and inflation run hotter than they have in the past with an accommodative stance, meaning lower interest rates than historical norms.

If you believe rates will not rise, and inflation will run at a reasonable rate of 2-3%, then bonds have no real return and cash has a negative rate of return. If you believe that rates rise, albeit slowly, then bonds will have a negative rate of return and cash will be a better place to be, though will still have a negative return, just less severe.

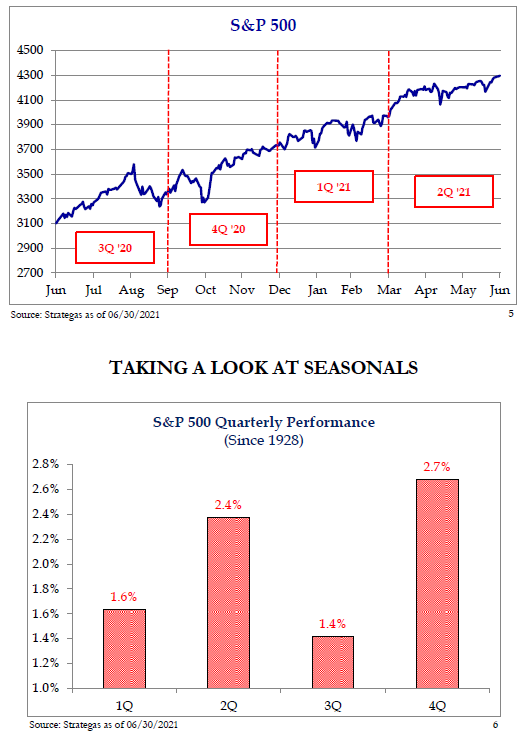

Could the sustained bull market in stocks simply be inflation in the value of publicly traded businesses and their future returns? We think this may explain some of the strong sentiment and price action we have seen this year.

We note that earnings have been stronger than the markets anticipated, and future earnings estimates could prove to be too conservative. Inflation affects earnings too, and they rise as a result, if pricing power is maintained. We think this is what markets are looking forward too, and if so, stocks may be attractively priced at current levels.

However, we do believe stocks will experience volatility, and we view this as a normal part of a healthy market. But we think that stocks will likely be the only public vehicle for real, after inflation, returns over the next few years.

John C. Cheshire

Chief Investment Officer

07/08/2021

Citations

[1] www.strategasrp.com “Quarterly Review in Charts Thu. Jul 1, 2021”

[2] www.strategasrp.com “Quarterly Review in Charts Thu. Jul 1, 2021”

[3] www.strategasrp.com “Quarterly Review in Charts Thu. Jul 1, 2021”

[4] https://www.macrotrends.net/futures/lumber

[5] www.strategasrp.com “Quarterly Review in Charts Thu. Jul 1, 2021”

[6] www.strategasrp.com “Quarterly Review in Charts Thu. Jul 1, 2021”

Additional Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2017-2