All eyes are currently on Washington and the outcomes of potential legislation. The future of tax policy, fiscal stimulus and infrastructure spending, and even the ever recurring side show of the debt ceiling discussions. We believe we will have a new environment to navigate once we see the results of the political wrangling.

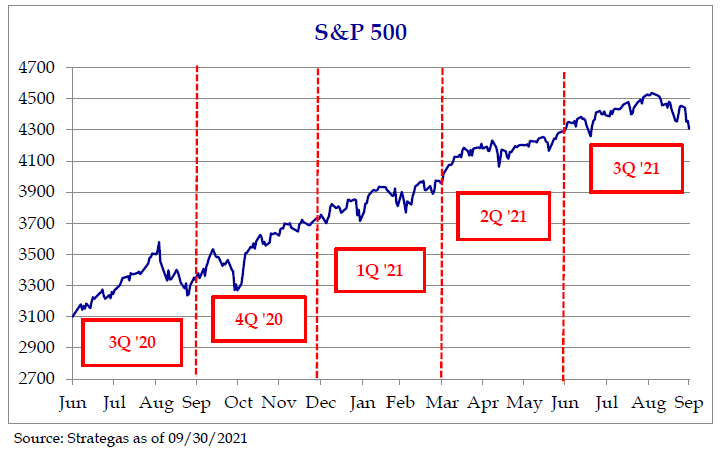

It’s often said bull markets like to climb a wall of worry, and there seems to be a constant stream of worries. However, we believe there has also been plenty of ebullience in the markets, as displayed in the 15.9% gain the S&P 500 has returned from 1/1/21 – 9/30/21.

There is a great amount of rhetoric around transitory versus sustained inflation. We believe it may need to be simply thought of as episodic. It has happened, it will likely decelerate, but is most likely not to be sustained at current higher rates. We think many prices simply don’t go down, but its highly doubtful that inflation continues at its torrid pace.

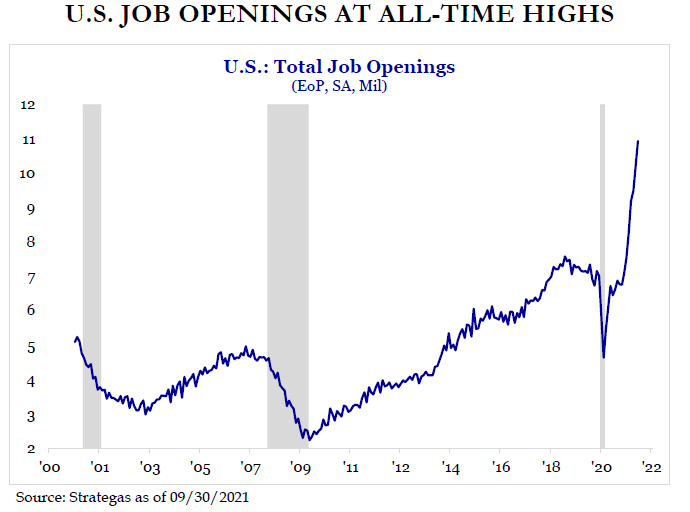

However, the one exception where we think inflation may just be beginning, is in wages. The current labor shortage could prove to be persistent, leading to sustained wage cost increases. We believe, this is bad for corporate margins, but likely good for income inequality, especially at the lower ends of the wage earner spectrum. This could be the form of sustained inflation we do see over the next few years, as our economy adjusts to the post-Covid world.

So, we believe that companies with high labor input costs may see margins squeezed, unless they have pricing power. Overall, we are generally in the camp of continued downward pressure on many cost inputs due to technological innovation. Hence, we struggle to believe inflation can be a runaway event and too disruptive once we move beyond this episode of post Covid adjustment.

We are in the current belief that interest rates will slowly creep up over the next few decades, but not at a significant speed. There does not seem to be political will to let interest rates find a natural path. Between the control of short-term rates and manipulation of long-term rates, via quantitative easing, we have assuaged economic disruption. However, the future of inflation likely does influence the speed and velocity of the potential of rising rates.

We believe economic growth offsets the pain of rising rates, and has historically created the environment to cause rates to rise. So, we do not fear a slow grind higher in rates for equity markets. In fact, we favor the backdrop of economic growth and slowly rising interest rates for stock prices. Bond prices though will be challenged if rates rise. Therefore, we believe short term fixed income is far more attractive than long term fixed income.

As is required in today’s ever-changing environment, we reserve the right to change our minds swiftly and regularly as the data presents new evidence, but for now we are comfortable with equity prices. We do think markets could use a breather, and that the normally occurring 5% to 10% correction would be a positive, not a negative, for the market’s general health. We will note however though that we have had a rolling correction in individual sectors. The rather placid changes and upward trajectory in index levels have belied the underlying volatility in individual securities and industry sectors.

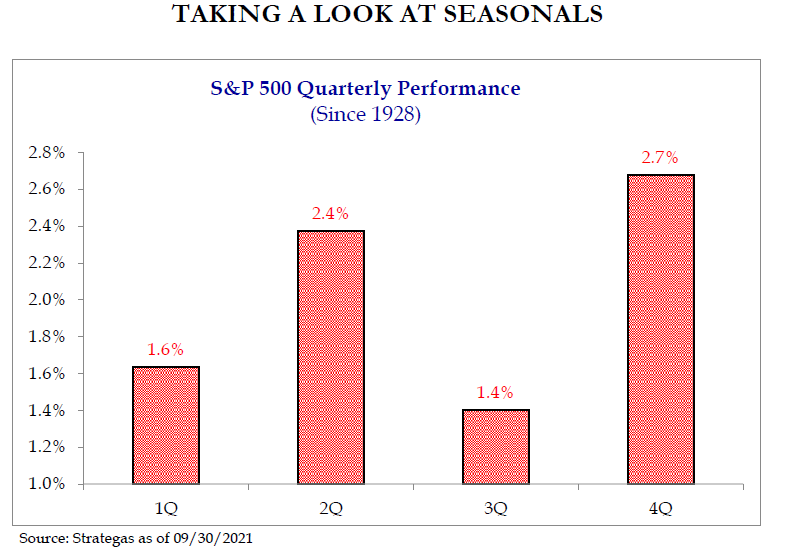

Though we would be thrilled to simply keep the rather nice double digit return the markets have given us so far this year, we do think that we could see both episodes of volatility and further price gains into the 4th quarter. In our opinion, the seasonal data favors the potential for a fourth quarter rally and possibly additional returns.

We do think valuations are full in some areas of the market, but we also think there are attractive pockets to deploy capital, especially with the rolling sector correction. Long-term we have more muted expectations of returns than markets have given us the last few years, but we also think that the past fiscal stimulus, and the potential for additional stimulus, could pave the way to a long-term period of economic growth. In closing, we remain constructive in our view of the markets and the US economy, albeit with continued expectations for periods of volatility.

John C. Cheshire

Chief Investment Officer

10/29/2021

Citations

[1] www.strategasrp.com “Quarterly Review in Charts Mon. Oct 4, 2021”

[2] www.strategasrp.com “Quarterly Review in Charts Mon. Oct 4, 2021”

[3] www.strategasrp.com “Quarterly Review in Charts Mon. Oct 4, 2021”

[4] www.strategasrp.com “Quarterly Review in Charts Mon. Oct 4, 2021”

[5] www.strategasrp.com “Quarterly Review in Charts Mon. Oct 4, 2021”

Additional Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2110-1