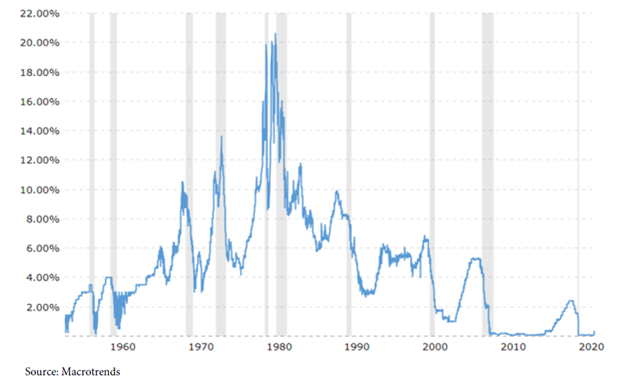

With all the news on the war in Ukraine, supply chain disruptions and rising commodity prices, it is easy to overlook what we believe is the most critical issue facing investors going forward, the regime change in interest rates. For almost all our careers we have invested in an environment of falling rates. In fact, one must go back to the period of the 1950s through early 1980s to find a rising rate environment.1 We believe this is no longer the case for investors as we look forward.

Headlines on inflation dominate our media, and they can be extremely influential on the markets. The Federal Reserve (Fed) is signaling it will continue to increase rates, and potentially aggressively raise them, along with quantitative tightening. We have experienced previous Fed rate increase cycles, and we can study the rising rate environment, but have little historical data on the effect of quantitative tightening.

The Fed draws some of the best and brightest minds in finance, and it is a literal think tank. We, in the US, are so incredibly fortunate to have one of the wealthiest economies in the world, and the dominant global currency and its stability. This is a result of many factors, one of which is the independence and actions of the Fed.

To maintain a strong currency with stable purchasing power, there are two enemies: inflation and deflation. Of the two, deflation is likely worse, and it has been an underlying economic force we have all worried about in financial markets over the last decade. Now, the force we are all focused on is inflation.

Fortunately, the Fed is now focused on fighting inflation, and knows it must take action to reduce its impacts upon our currency, economy, and standard of living. Members of the Fed are regularly telegraphing that they will raise rates and do what it takes to ameliorate the inflation issue. We have faith in the Fed but fear it may be painful for markets and cause volatility in the near term as we navigate the rising rate environment that we anticipate.

Markets are trying to sort this out. We believe this year’s first quarter has been an example of markets trying to reprice assets for inflation and rising interest rates. In our view, the numbers for equities belie the underlying damage to growth stocks, especially in the small cap space.

We are comforted by the fact that historically, one of the most resilient assets to inflation have been stocks, and we believe this will continue to be the case. In fact, we have had a focus on helping clients increase their equity exposure and minimize longer duration fixed income within their comfort levels

As such, we have made some portfolio construction changes. For equities we have increased our exposure to lower multiple, lower duration stocks with what we view to have attractive dividend yields for a portion of the portfolio. This has the effect of lowering the duration, as well as increasing cash flow. We believe this is beneficial in times of volatility as it provides cash flows that can be reinvested. We have also focused on companies that have pricing power, and which will not, if inflation persists. This view is currently a focus in our portfolio construction.

For fixed income, we have shifted to a considerably shorter duration. We do take the Fed signaling on rates seriously and think that the place of most pain is potentially the bond market. We have transitioned to shorten duration and plan on staying there until we see a more neutral rate to inflation. We think that for investors who use bonds to buffer volatility and express an element of predictability, liquidity, and

safety as a portion of their portfolio, this is a prudent and wise course of action. Bonds are where we prefer not to take risk. The risk budget for portfolio construction is, in our opinion, better served in the equity allocation.

In our view, volatility creates opportunity in markets, and we anticipate using this to our advantage. We view this new rising rate regime as a longer-term environment for investors going forward. The last two rate cycles, rising rates from the 1950s through the 1980s, and falling rates till now, have been 30 to 40 years in duration. 1 We think this may the beginning of the new regime in interest rates.

As of June 1954 – April 2022

John C. Cheshire

Chief Investment Officer

04/12/2022

Citations

[1] https://www.macrotrends.net/2015/fed-funds-rate-historical-chart

Disclosures:

Please remember to contact Asio, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services.

Past performance is not indicative of future results. The opinions expressed herein are those of Asio Capital LLC (“Asio”) and are subject to change without notice. This material is not financial advice or an offer to sell any product. All investments and investment strategies involve risk. Asio reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

Forward looking statements cannot be guaranteed. The information herein is correct to the best of the knowledge of Asio as of the date indicated unless otherwise noted and is subject to change without notice, may not come to pass, and does not represent a recommendation or offer of any particular security, strategy, or investment. This information is confidential and for the use of the intended recipients only. It may not be reproduced, redistributed, or copied in whole or in part for any purpose without the prior written consent of Asio.

Information obtained from third party sources is believed to be reliable but is not guaranteed for accuracy or completeness. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Asio. There can be no assurance that the future performance of any specific investment, investment strategy or product will be profitable or prove successful.

Asio is an SEC registered investment adviser located in Lexington, Kentucky. Registration with the SEC does not imply a certain level of skill or training. More information about Asio including our advisory services, fees and objectives can be found in our ADV Part 2, which is available upon request. ASC-2205-01